Growth & Milestones

The evolution from a public employee credit union to a comprehensive community financial institution

From Local Roots to Regional Presence

What began as a modest financial cooperative serving county employees has evolved into a significant institution serving communities across Northern California. This transformation reflects not only organizational growth but a steadfast commitment to adapting to members' changing needs while preserving founding values.

Becoming a Full-Service Community Credit Union

The transition from a public employee credit union to a community-based financial institution marked a pivotal evolution. This transformation began in the late 1970s when membership eligibility expanded to include family members of existing members, creating the first pathway for broader community participation.

Throughout the 1980s and 1990s, the credit union methodically added new services that positioned it as a comprehensive alternative to traditional banks. Business accounts, mortgage lending, financial education programs, and investment services gradually joined the portfolio of offerings.

This expansion of services was matched by geographic growth. New branches opened across Sonoma County, followed by careful expansion into neighboring counties. Each new location maintained the personalized service model that distinguished the credit union from larger financial institutions.

Major Milestones

Family Membership

Eligibility expanded to include family members of existing members, marking the first step toward community orientation.

First Computer System

Implementation of the first computerized accounting system, replacing manual ledgers and revolutionizing service capabilities.

Home Loan Program

Launch of a comprehensive mortgage lending program, helping members achieve homeownership in increasingly expensive Northern California.

Community Charter

Received approval for a community charter, allowing anyone who lives or works in the service area to join, regardless of employer.

Digital Banking Launch

Introduction of online banking services, providing members with 24/7 access to accounts and marking the beginning of the digital transformation.

Business Services Division

Establishment of specialized services for small businesses, including commercial loans, merchant services, and business checking accounts.

Wildfire Response

Mobilized significant resources to support members and communities affected by devastating Northern California wildfires, reinforcing the institution's community commitment.

Digital Transformation

Accelerated implementation of advanced digital banking platforms, enabling seamless remote financial management during the global pandemic.

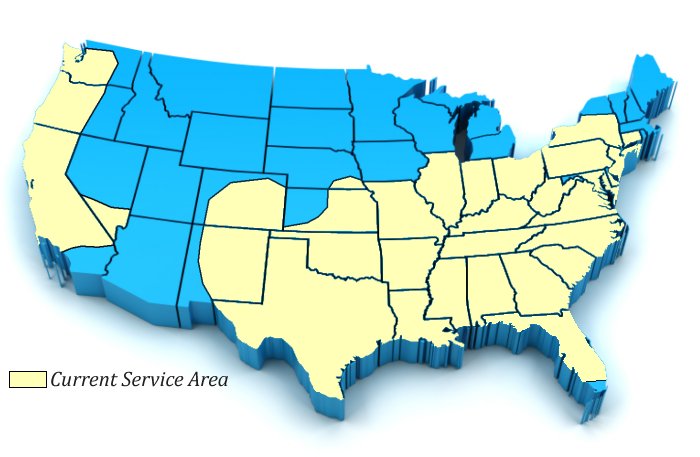

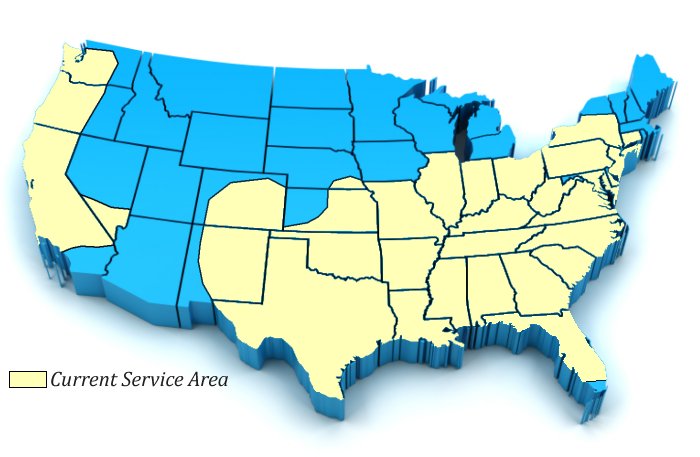

Current Service Areas

Sonoma County

Original founding location with the highest concentration of branches serving both urban and rural communities.

Marin County

Expanded services to this area in the 1990s, bringing the credit union's community-focused approach to new neighborhoods.

Napa County

Serving the unique needs of wine country communities with specialized agricultural financial services.

San Francisco

Urban presence established in the early 2000s, providing an alternative to large national banks in the financial district.

Lake County

Expansion into this rural region brought much-needed financial services to underserved communities.

Mendocino County

Coastal and inland communities gained access to community-focused financial services through strategic branch placements.

Looking Forward While Honoring the Past

"The history of this institution demonstrates that growth and innovation can coexist with unwavering commitment to founding principles. As new technologies and services have been adopted, the fundamental mission of people helping people has remained constant."— From the credit union's 50th anniversary historical publication

As the institution continues to evolve, historical records show a consistent pattern of balancing innovation with tradition. Digital transformation initiatives are designed to enhance rather than replace the personal connections that have defined the organization since 1950.

The archives highlight how community involvement has expanded in parallel with financial services. Educational programs, environmental initiatives, and disaster response capabilities have become increasingly sophisticated while maintaining the grassroots engagement that characterized early operations.